$35 Top Growth Stocks : Smart Buys for Long-Term Investors

Analyst Tom Lee from Fundstrat predicts that in 2024, numerous U.S. stocks will experience an upsurge, driven by expected interest rate cuts by the Federal Reserve, decreasing yields on the 10-year Treasury note, a more relaxed housing market, improved prospects for business capital expenditure, and anticipated inflows into money market funds.

UiPath (NYSE: PATH) and Confluent (NASDAQ: CFLT), both of which are poised for substantial growth in 2024. These stocks, currently priced at less than $35 per share, offer potential long-term investment prospects.

What is Growth Stock?

Stocks are typically classified as either value or growth stocks.Value stock trade at a lower price relative to their financial performance…. Read More

How do you choose stock?

Discovering undervalued companies that have the potential to outperform the stock market can be a challenging task in value investing. However, certain metrics can …..Read More

Clear your Why :

Why Invest in UiPath (NYSE: PATH)?

UiPath As a Growth Stock

UiPath specializes in harnessing the power of robotic process automation (RPA) tools and artificial intelligence (AI) technologies to assist businesses in automating and streamlining repetitive and rule-based tasks. This optimization enhances their cost efficiency and productivity.

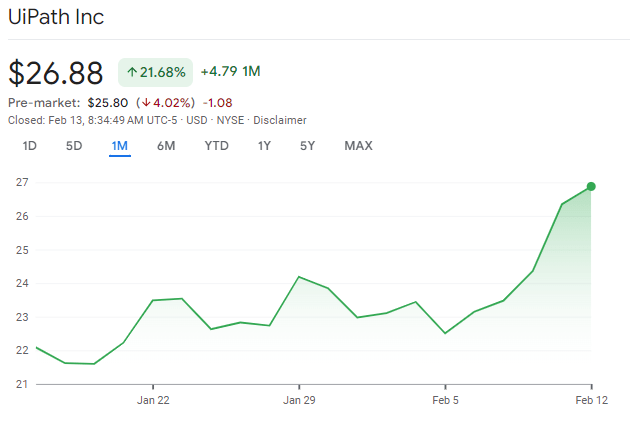

As Wall Street praised the automation software business following a beat in earnings, UiPath Inc.’s stock on 1st December2023, was easily heading towards its greatest day ever.

Because of its unique strategy of fusing specialised AI with general AI, UiPath is an automation leader and should profit from significant [generative-AI] interest,its a growth stock according to analyst Terry Tillman of Truist Securities. This will ultimately lead to improved accuracy and a faster time to value for clients.

Tillman raised his price objective from $20 to $28 in his most recent report and maintained a buy recommendation on UiPath’s shares, PATH, +2.01%.

With a 27.1% advance in Friday’s trade, UiPath shares are on course to record their highest percentage gain in a single day on record—a feat that will require surpassing the 17.6% gain recorded on March 16.

The company is experiencing strong demand for its automation tools across various traditional industries, including telecommunications, retail, manufacturing, and consumer packaged goods. Its focus on tailoring automation solutions to specific industry needs rather than offering a generic approach sets it apart. By leveraging its deep understanding of industry-specific processes, UiPath delivers targeted solutions.

JPMorgan’s Mark Murphy remarked that “there is still work to be done, most evident in continued [annual recurring revenue] growth deceleration,” though he and his team “think that UiPath is executing well, benefiting from easier comps and relatively more stable conditions compared to the last several quarters, and ARR growth-deceleration is moderating.”

He also noted that UiPath’s growth stock, currently trading at about six to seven times enterprise value to estimated calendar 2024 revenue, appears “somewhat washed out.” This is because “it could take some time to work through the macro pressures, repositioning, and repackaging to drive a meaningful re-acceleration in ARR growth.”

Collaborations with global system integrators and strategic partners further expand its reach and customer base. The introduction of Autopilot, a set of generative AI-powered capabilities, is anticipated to drive significant growth by accelerating automation testing and enhancing specialized document understanding and communication mining models.

UiPath’s financial performance is strong, with a 24% year-over-year increase in ARR to $1.38 billion in the third quarter of fiscal 2024. Profitability and positive free cash flow are reported on a non-GAAP basis. With the RPA market projected to grow at a CAGR of 37.9% from $2.6 billion in 2022 to $66 billion in 2032, UiPath is poised for substantial growth in the future.it is a growth stock.

Why Trading Up Confluent:(NASDAQ: CFLT)

Confluent As a Growth Stock

Confluent is a key player in enabling companies to process and analyze vast amounts of real-time streaming data for actionable insights. Its comprehensive data streaming solution operates across multiple clouds and on-premise environments, offering clients a holistic real-time view of their data.

Confluent has increased 38.1% since the year began, but its share price of $31.35 is still 20.2% below its 52-week high of $39.27 set in July 2023. At the June 2021 IPO, investors who purchased $1,000 worth of Confluent shares would currently be looking at an investment worth $697.02.

As the primary commercial provider of the Apache Kafka open-source distributed streaming platform, Confluent benefits from continuous innovation and feedback from the open-source community. The addition of data governance capabilities and the Flink open-source streaming processing framework enhances its platform’s capabilities and market penetration.

The growing adoption of AI technologies further drives demand for Confluent’s data streaming platform, as data is fundamental to AI strategies. The company boasts nearly 4,960 businesses as of the fourth quarter of fiscal 2023, with strong growth in high-value clients generating over $1 million in ARR.

As a growth stock, the company’s revenue for the quarter was higher than what Wall Street had predicted. It’s also important to note that Confluent’s gross margin has increased over this time. In response to the findings, Bank of America reduced the price target from $38 to $24 and downgraded the stock from Neutral to Underperform.

Confluent’s transition from a bookings model to a consumption-based model for its cloud business aims to attract new customers and workloads by reducing upfront costs. Despite a recent surge in its shares following stellar fourth-quarter results, Confluent’s stock is trading at a relatively low price-to-sales ratio compared to its historical average, making it an attractive investment opportunity in 2024.

Want to know other Growth Stock….

1 thought on “$35 Growth Stock: (NYSE: PATH) & (NASDAQ: CFLT) for Long-Term Investors”