Monthly dividend stocks distinguish themselves with their frequent payout schedule, providing income every month as opposed to the more typical quarterly dividends. This feature is particularly attractive to individuals seeking consistent income streams.

These stocks distribute a portion of profits to shareholders regularly, offering a dependable income stream, particularly valuable in uncertain market conditions. However, not all companies offer dividends, and even those that do may reduce payments during challenging periods.

One of the best parts of dividend stocks is the pleasure of seeing your payout deposited in your brokerage account without you having to lift a finger – real passive income. And monthly dividend stocks let you experience that joy 12 times a year instead of just the typical four times.

Top monthly dividend stocks:

Here are top monthly dividend stocks, an often-overlooked source for monthly dividends as well as what to watch out for as you search for monthly dividend stocks.

Best 5 Monthly Dividend Stocks:

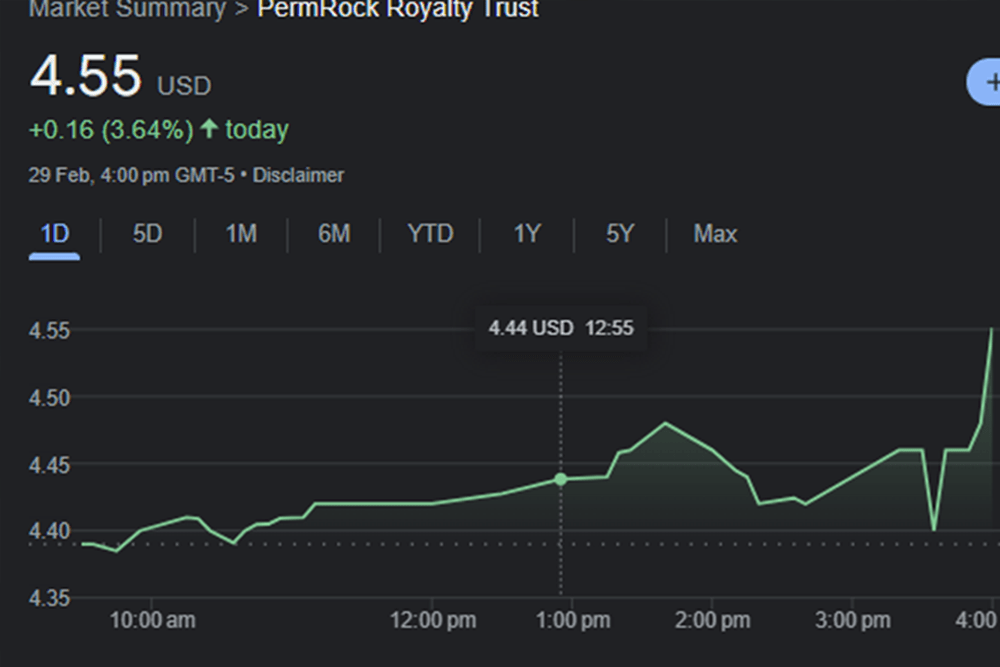

1. PermRock Royalty Trust (PRT)

PermRock Royalty Trust (PRT) operates within the prolific Permian Basin, one of North America’s largest and most productive oil and natural gas regions. As a publicly traded trust, PRT holds valuable royalty rights, entitling it to 80% of the profits generated by properties owned by Boaz Energy II LLC in this energy-rich area.

Market cap: $55.35 million

12-month yield: 9.96%

Given that PRT’s income distributions hinge on the profitability of the underlying company, they exhibit high sensitivity to energy prices. For instance, on June 29, 2022, PRT paid a historic dividend of 10 cents per share when crude oil traded above $114 a barrel. Conversely, on Feb. 28, 2024, PRT distributed a dividend of 3 cents per share, coinciding with oil prices around $79 per barrel.

Energy prices are subject to cyclical fluctuations. Should oil and natural gas maintain their upward trajectory since December of the previous year, PRT shareholders stand to benefit from increasing dividends.

2. Realty Income (O):

Realty Income, a REIT proudly dubbed “The Monthly Dividend Company,” specializes in single-unit commercial properties leased to high-quality tenants for extended periods, typically exceeding 10 years.

Market cap: $44.87 billion

12-month yield: 6.5%

Kicking off our list is Realty Income Corporation (O), a prominent real estate investment trust (REIT) renowned for its extensive portfolio of commercial properties across the United States, Puerto Rico, and the United Kingdom. With a specialization in single-tenant, triple-net lease agreements, the company primarily focuses on retail and commercial spaces occupied by tenants in non-cyclical industries.

Recently, Realty Income Corp finalized its merger with Spirit Realty Capital, Inc. in an all-stock transaction, consolidating two significant players in the real estate market. The merged entity continues to trade under the ticker “O” on the New York Stock Exchange. The merger, which garnered approval from Spirit stockholders, entailed Spirit common stockholders receiving $0.762 shares of Realty Income common stock for each share they owned.

Year-to-date, shares of O stock have experienced a 9.92% decline. In Monday morning’s trading session, O stock reflects a 2.64% decrease, trading at $52.75 per share.

3.Agree Realty (ADC):

With a vast portfolio of over 1,500 properties leased to retail giants like Advance Auto Parts and PetSmart, Agree Realty transitioned to a monthly dividend schedule in 2021.

Market cap: $5.52 billion

12-month yield: 5.0%

The exponential rise of online shopping has posed significant challenges to brick-and-mortar retail real estate in recent decades. However, Agree Realty Corporation (ADC), a real estate investment trust (REIT), is tackling this challenge head-on with pride in its innovative approach and distinctive financing methods.

As a retail REIT, ADC specializes in leasing space to creditworthy tenants under long-term, net-lease agreements. In this arrangement, tenants assume responsibility for the upkeep, taxes, and insurance of the buildings they occupy.

With a portfolio spanning over 2,100 properties across 49 states, ADC commands control over 44 million square feet of rentable space. Since its inception in 1994, ADC management has consistently delivered a compound average total return of 11.8% since its initial public offering.

4. STAG Industrial (STAG):

Focusing on industrial properties and warehouses, STAG benefits from the e-commerce boom, anticipating significant growth as online shopping continues to rise.

Market cap: $6.7 billion

12-monthYield: 4.0%

Stag Industrial Inc. (STAG) operates as a real estate investment trust, specializing in acquiring and managing single-tenant industrial properties across the United States. The company’s focus encompasses properties accommodating tenants from diverse sectors, including manufacturing, distribution, and warehousing.

In recent news, STAG Industrial declared an uptick in its monthly common stock dividends to $0.123333 per share, resulting in an annual rate of $1.48 per share. The company’s Board of Directors announced dividends for the first quarter of 2024, with payments slated for mid-February, mid-March, and mid-April, corresponding to record dates at the end of January, February, and March, respectively.

Year-to-date, STAG stock has seen a decline of 7.07%. Presently, during Monday morning’s trading session, Stag Industrial stock registers a 2.13% decrease from the opening, trading at $36.79 per share.

5. Ellington Financial Inc. (EFC)

Ellington Financial Inc. (EFC) operates as a mortgage real estate investment trust (mREIT) headquartered in Old Greenwich, Connecticut, distinguished by its dual business lines.

Market cap: $940 million

12-month yield: 16.5%

In its investment portfolio division, EFC acquires and manages an income-producing portfolio of mortgage bonds backed by one or more U.S. government housing agencies. Additionally, EFC diversifies its mortgage portfolio by holding corporate and consumer debt. Through its Longbridge Financial segment, EFC specializes in originating and servicing reverse mortgages tailored to older Americans.

Wall Street analysts project EFC to generate $190 million in revenue for fiscal 2024. As a REIT, EFC is mandated to distribute at least 90% of its taxable income as dividends.

Must Read: $10,000 Passive Income from 3 Energy Dividend Stocks!

Others Monthly Dividend Stocks

SL Green (SLG):

SL Green, New York City’s largest office real estate owner, manages numerous Big Apple office spaces, remaining a prominent player despite ongoing remote work trends.

Market cap: $3.14 billion

12-month yield:7.3%

AGNC Investment (AGNC):

AGNC Investment operates as a mortgage REIT, holding mortgages on real estate instead of the properties themselves. Despite dividend fluctuations, it has a track record of sizable payouts.

Market cap: $6.64 billion

12-month yield: 16.1%

Apple Hospitality REIT (APLE):

Managing over 200 hotels under renowned brands like Marriott and Hilton, Apple Hospitality REIT rebounded from pandemic challenges to resume monthly dividends.

Market cap: $3.8 billion

12-month yield: 5.7%

EPR Properties (EPR):

Known as an experiential REIT, EPR invests in properties offering leisure experiences, including movie theaters and ski resorts, resuming monthly payouts post-pandemic.

Market cap: $3.4 billion

12-month yield: 7.2%

LTC Properties Inc. (LTC)

LTC Properties Inc.operates within the thriving senior housing and healthcare sectors of the commercial real estate industry. With the aging population and the ongoing retirement of the baby boomer generation, these sectors have emerged as particularly lucrative. As a real estate investment trust (REIT), LTC capitalizes on the opportunities presented by this profitable field.

Market cap: $1.36 billion

12-month yield: 7.2%

1 thought on “Best Monthly Dividend Stocks”