In the intricate tapestry of the Forex market, ING‘s recent analysis offers a deep dive into the dynamics shaping Latin American currencies in 2024. From political shifts to fiscal concerns, let’s unravel the nuances of USDARS, USDBRL, BRLMXN, and USDCLP.

In the dynamic landscape of Forex, ING’s recent insights into Latin American currencies for 2024 provide a nuanced perspective. From the delicate balance of USDARS amidst political shifts to the resilience of BRLMXN fueled by investor confidence, each currency tells a unique story. USDBRL’s low volatility, despite fiscal concerns, and USDCLP grappling with the aftermath of a rate cut add depth to the narrative. Navigating uncertainties, ING’s guidance acts as a valuable compass, offering traders insights to stay informed and ahead in this evolving Forex terrain.

Table of Contents

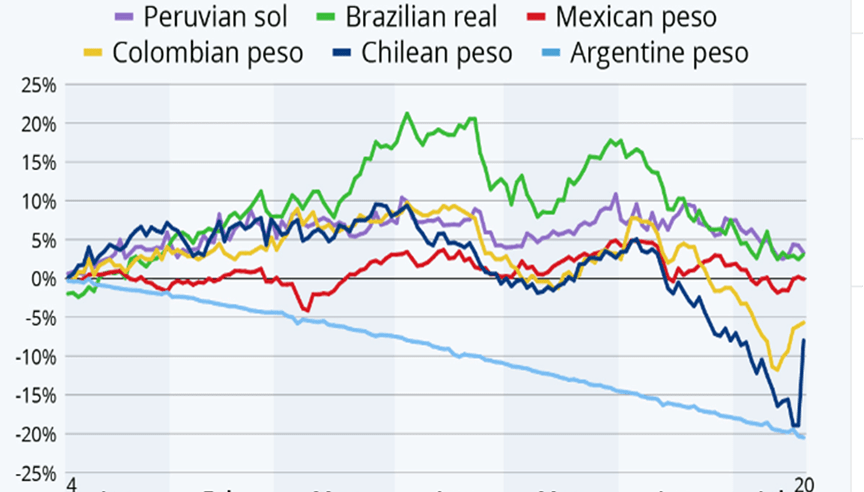

Mixed Fortunes in 2024: A Balancing Act for Latin American Currencies

The Forex arena is witnessing a mosaic of challenges and opportunities as Latin American currencies navigate the complex landscape in 2024. ING’s insightful commentary provides a nuanced perspective on the performance of key currencies in the region.

USDARS: A Delicate Balance Amidst Political Shifts

At the heart of this narrative is the Argentine peso (ARS), delicately balanced as USDARS hovers close to 2000 against the official rate of 827. ING points to the impact of President Javier Milei’s administration, tweaking its aggressive spending cuts. The recent approval of a substantial disbursement by the International Monetary Fund signals a dynamic environment for the ARS.

USDBRL: Low Volatility Amidst Fiscal Concerns

Despite looming fiscal concerns in Brazil, the USDBRL realized volatility remains remarkably low. ING underlines the potential challenge for Brazil’s government to uphold its pledge of a primary fiscal balance at 0% of GDP. The focus leans towards a lower trajectory for BRLMXN.

BRLMXN: Favoring a Downward Trajectory

In the expansive Latin American landscape, the Mexican peso (MNX) stands as the sole currency appreciating against the USD on a total return basis. ING attributes this resilience to investor confidence, driven by a combination of loose fiscal policies and tight monetary measures.

USDCLP: Chilean Peso’s Dilemma Post Rate Cut

The Chilean peso (CPL) grapples with the aftermath of a 100bps rate cut by Chile’s central bank (BCCh). ING questions whether the BCCh might now regret this decision as USDCLP hovers around 950.

Navigating Uncertainties in Latin American Forex:

ING’s Guidance As Latin American currencies traverse a diverse terrain, traders face the challenge of balancing political shifts, fiscal concerns, and rate adjustments. ING’s insights act as a compass, offering guidance for navigating the uncertainties and providing a valuable perspective on the intricacies of Forex dynamics in the region.

Conclusion: Stay Informed, Stay Ahead in Latin American Forex

With every shift in Latin American currencies carrying weight, ING’s commentary serves as a beacon of information. The Forex landscape is one of constant evolution, and ING’s insights contribute to the ongoing narrative, offering traders a valuable tool for staying informed and staying ahead.

As the Latin American Forex story unfolds, keep a close eye on the key currencies, guided by ING’s expert analysis into the heart of this dynamic financial arena.

If you want to know more news follow us on investment and stock news