MoneyQuince Mortgage Calculator:

Monthly Calculator

Mortgage Calculator

Mortgage Calculator

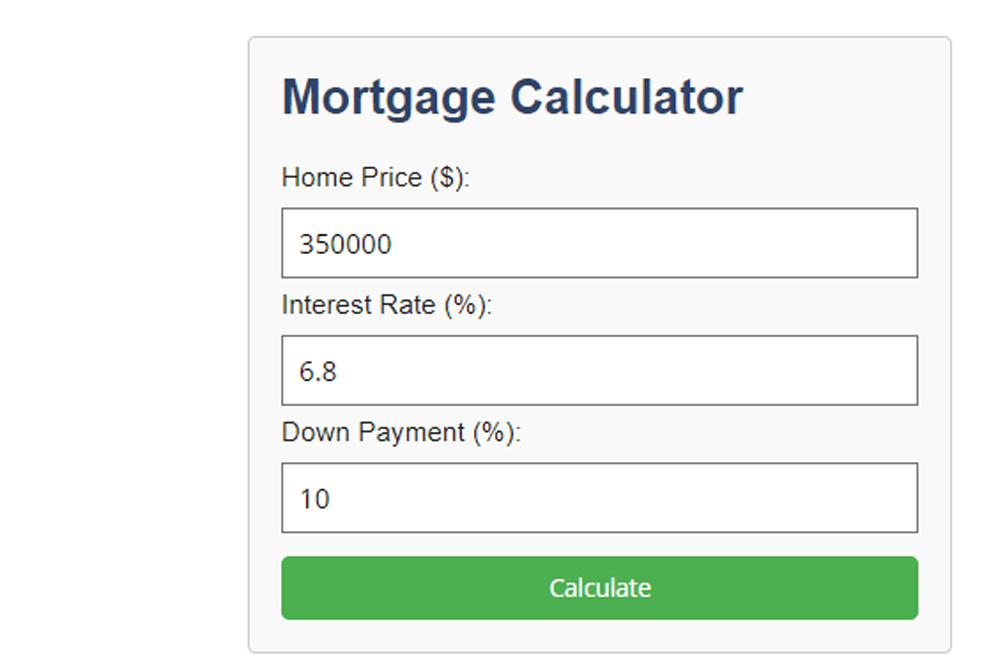

Mortgage Calculator with Down Payment:

You can input the home price, interest rate, and down payment percentage, and it calculates the monthly mortgage payment accordingly. Adjustments can be made to fit specific needs, such as loan term and additional fees.

Learn More :How to Buy A House With Bad Credit 2024

What is mortgage escrow account ?

A mortgage escrow account, also known as an impound account, is a specific type of escrow account established by mortgage lenders to manage and distribute funds for property-related expenses on behalf of the borrower. Here’s an overview of mortgage escrow accounts:.[1]

- Purpose: The primary purpose of a mortgage escrow account is to ensure that funds are available to pay property taxes, homeowners insurance, and other related expenses when they become due. By collecting a portion of these expenses along with the monthly mortgage payment, the lender can ensure that the borrower remains current on these obligations.

- Monthly Contributions: Borrowers make monthly contributions to the mortgage escrow account along with their regular mortgage payments. These contributions are typically estimated based on the annual expenses for property taxes and insurance, divided into monthly installments.

- Management of Funds: The lender holds the funds in the escrow account and disburses payments for property taxes, homeowners insurance premiums, and sometimes other expenses, such as mortgage insurance or homeowners association fees, when they become due. The lender is responsible for ensuring that these payments are made on time to avoid penalties or late fees.

- Adjustments: The lender may periodically review and adjust the escrow account to ensure that it remains adequately funded. This may involve increasing or decreasing the monthly escrow payments based on changes in property taxes or insurance premiums.

- Regulatory Requirements: In some cases, lenders are required by law to maintain escrow accounts for certain types of loans. For example, loans insured by the Federal Housing Administration (FHA) or Department of Veterans Affairs (VA) typically require escrow accounts for property taxes and insurance.

- Transparency: Lenders are required to provide borrowers with an annual escrow account statement detailing the activity in the account, including the amounts collected, disbursements made, and any surplus or shortage. This statement helps borrowers understand how their escrow funds are being managed.

Overall, a mortgage escrow account provides a convenient and efficient way for borrowers to manage property-related expenses and ensure that they remain current on their obligations. By spreading these expenses out over the course of the year, borrowers can avoid large lump-sum payments and budget more effectively for homeownership costs.

How to Open an escrow account ?

Opening an escrow account typically involves the following steps:

- Identify a Need: Determine the need for an escrow account, whether it’s for a real estate transaction, mortgage payments, business transaction, legal matter, or another purpose.

- Select an Escrow Agent: Choose a trusted escrow agent or company to handle the account. This could be a title company, attorney, financial institution, or specialized escrow service provider.

- Negotiate Terms: Negotiate the terms of the escrow agreement, including the responsibilities of each party, the timeline for depositing funds, any conditions or contingencies, and the disbursement process.

- Deposit Funds: Deposit the required funds or assets into the escrow account according to the terms of the agreement. This may involve an initial deposit to open the account and subsequent contributions over time.

- Execute Agreement: Sign the escrow agreement, outlining the terms and conditions agreed upon by all parties involved in the transaction.

- Monitor Account: Monitor the escrow account to ensure that funds are deposited and disbursed correctly according to the terms of the agreement. Keep track of any deadlines or milestones specified in the agreement.

- Close Account: Once the transaction is completed, and all conditions are met, the escrow agent will disburse the funds or assets according to the instructions outlined in the agreement. The escrow account is then closed.

It’s essential to work with a reputable escrow agent or company and carefully review all terms and conditions before opening an escrow account to ensure that your interests are protected throughout the transaction

How to Set up an escrow account ?

To set up an escrow account, follow these general steps:

- Choose an Escrow Agent: Decide who will manage the escrow account. This could be a title company, attorney, financial institution, or specialized escrow service provider. Ensure they are reputable and experienced in handling escrow transactions.

- Negotiate Terms: Discuss and agree on the terms of the escrow arrangement. This includes determining the purpose of the account, the responsibilities of each party, the timeline for depositing funds, any conditions or contingencies, and the disbursement process.

- Complete Documentation: Prepare and sign an escrow agreement outlining the terms and conditions agreed upon by all parties involved in the transaction. This document should clearly specify the purpose of the escrow account, the parties involved, the funds or assets to be deposited, and the conditions for disbursement.

- Deposit Funds: Make an initial deposit into the escrow account as required by the agreement. This may involve transferring funds electronically or providing a certified check or wire transfer to the escrow agent.

- Maintain Records: Keep detailed records of all transactions and communications related to the escrow account. This includes copies of the escrow agreement, receipts for deposits, and any correspondence with the escrow agent.

- Monitor Account: Regularly monitor the escrow account to ensure that funds are deposited and disbursed correctly according to the terms of the agreement. Stay informed about any deadlines or milestones specified in the agreement.

- Close Account: Once the transaction is completed, and all conditions are met, the escrow agent will disburse the funds or assets according to the instructions outlined in the agreement. The escrow account is then closed, and any remaining funds are returned to the appropriate parties.

It’s important to work closely with the escrow agent and carefully review all terms and conditions before setting up an escrow account to ensure that your interests are protected throughout the transaction.

2 thoughts on “Mortgage Calculator”