Dividend King Keith Speights (AbbVie):

AbbVie Inc. As a stalwart in the pharmaceutical industry, AbbVie stands tall as a Dividend King, offering a compelling combination of robust dividend yields and consistent growth. Investors called it Dividend King.

AbbVie, under new leadership with Rob Michael taking over from longtime CEO Rick Gonzalez, enters a pivotal stage marked by the loss of U.S. patent exclusivity for its top-selling drug, Humira. Despite this challenge, AbbVie remains bullish about its future prospects, projecting solid growth starting in 2025. The company anticipates achieving a high-single-digit compound annual growth rate in revenue through the remainder of the decade.

The Historical performance data for AbbVie Inc (ABBV):

| Performance Metric | Value |

| YTD Total Return | 10.75% |

| TTM Total Return | 10% |

| 5-Year Total Return | 156.61% |

| 10-Year Total Return | 406.69% |

| TTM Total Return CAGR | 13.88% |

| 3-Year Total Return CAGR | 21.70% |

| 5-Year Total Return CAGR | 21.45% |

| 10-Year Total Return CAGR | 17.24% |

Insight into AbbVie’s performance over various time periods, showcasing its growth and return on investment.

Impressive Total Returns:

AbbVie has consistently delivered impressive total returns to investors, with a 5-year total return of 156.61% and a 10-year total return of 406.69%. These figures underscore the company’s ability to generate significant value for shareholders over the long term.

Strong Compound Annual Growth Rates (CAGR):

AbbVie’s total return compound annual growth rates (CAGRs) are equally impressive, with a TTM CAGR of 13.88%, a 3-year CAGR of 21.70%, a 5-year CAGR of 21.45%, and a 10-year CAGR of 17.24%. These growth rates reflect the company’s consistent performance and ability to deliver sustained returns over multiple time frames.

Resilient Revenue Growth:

Despite challenges such as the loss of exclusivity for its top-selling drug, Humira, AbbVie remains resilient, projecting a return to solid growth in 2025. The company anticipates achieving a high-single-digit compound annual growth rate in revenue through the rest of the decade, driven by promising successors to Humira and other key growth drivers in its portfolio.

Diverse Pipeline:

AbbVie boasts a diverse pipeline of innovative drugs across various therapeutic areas, including autoimmune diseases, antipsychotic medication, and migraine therapies. This diversification not only mitigates risks associated with patent expirations but also provides multiple avenues for future revenue growth.

Strategic Acquisitions:

AbbVie’s strategic acquisitions, such as Cerevel Therapeutics and Immunogen, further enhance its growth prospects. These acquisitions expand AbbVie’s product portfolio and pipeline, positioning the company for continued success in the competitive pharmaceutical industry.

Why you Choose it ?

By 2027, AbbVie foresees its Humira successors, Rinvoq and Skyrizi, generating combined sales exceeding $27 billion, surpassing Humira’s peak sales. Additionally, other growth drivers such as the antipsychotic drug Vraylar are expected to reach close to $5 billion in peak annual sales. Migraine therapies Ubrelvy and Qulipta are forecasted to collectively exceed $3 billion in peak sales annually. Further bolstering its pipeline, AbbVie expects U.S. regulatory approval this year for ABBV-951, targeting Parkinson’s disease, with blockbuster potential.

Strategic acquisitions, such as the pending acquisition of Cerevel Therapeutics for approximately $8.4 billion and the completed buyout of Immunogen for $10.1 billion, are poised to augment AbbVie’s growth trajectory significantly.

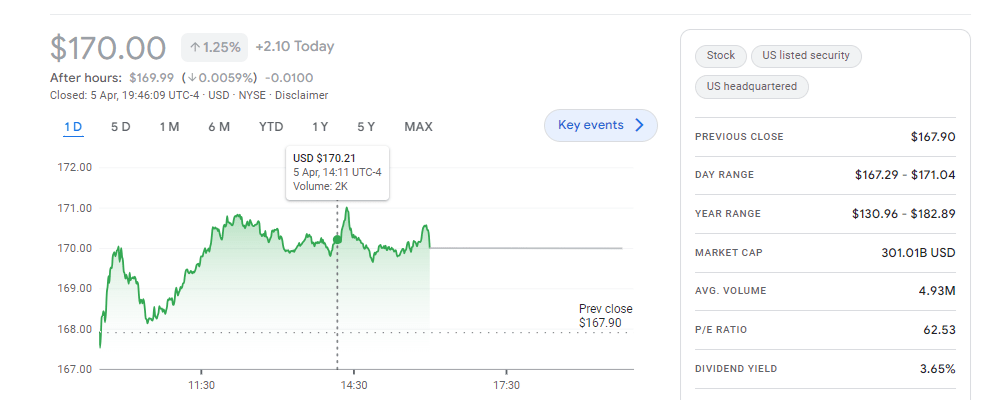

Despite these changes, one constant is AbbVie’s commitment to shareholders through its status as a Dividend King, boasting over 52 consecutive years of dividend increases. With a solid dividend yield of over 3.5%, AbbVie continues to attract income investors seeking reliable returns.

A blend of robust dividend yield and consistent growth. AbbVie boasts a substantial dividend yield of nearly 3.6%, a hallmark of its financial performance over the years. Notably, the company has a remarkable track record of dividend growth, having increased its payout by a staggering 288% since its separation from Abbott Labs in 2013. With an illustrious history of 52 consecutive years of dividend hikes (42 of those while under Abbott’s umbrella), AbbVie stands as a reliable choice for income investors.