WELLS FARGO COMPLETE REVIEWS :

WELLS FARGO: NMLS#399801

Our take:

Wells Fargo’s mortgage options could be attractive for current customers, featuring a range of home loan choices, including those with low down payment alternatives. However, the lender’s past involvement in government settlements might deter certain individuals.

| Criteria | Minimum Requirement |

|---|---|

| Credit Score | 620 |

| Down Payment | 3% |

| Loan Types/Products | Purchase, Refinance, Jumbo, Fixed, Adjustable, FHA, VA, USDA |

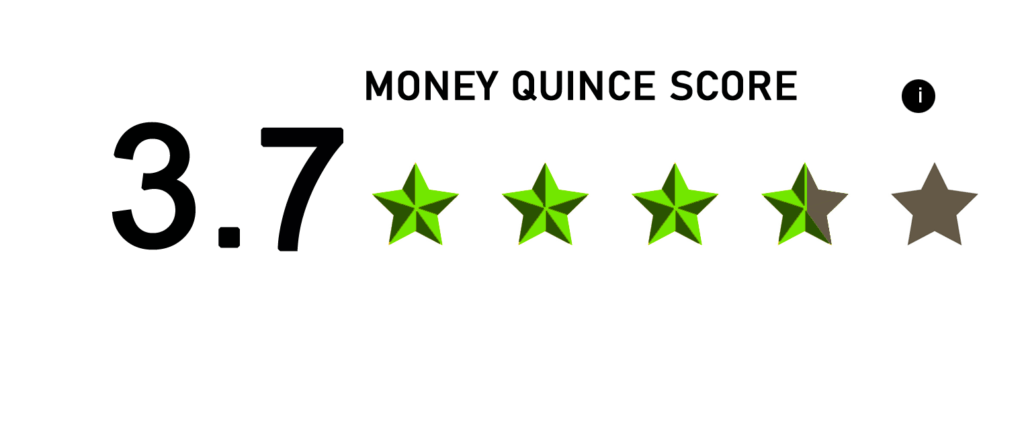

According to other financial institutions’ ratings and customer feedback database 3.4 out 5 .we recommend 3.0 out of 5 .

Key Points:

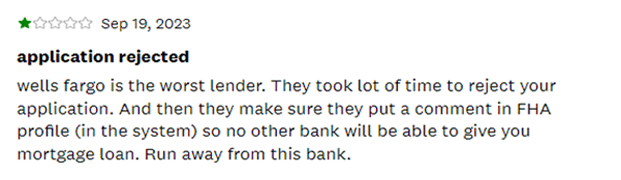

What People saying About wells Fargo

It’s concerning that most complaints regarding Wells Fargo revolve around conventional and FHA mortgages, particularly concerning the payment and closing processes. While it’s good to hear that the company is responding promptly to nearly all complaints, it’s important to note that the CFPB doesn’t verify the accuracy of consumers’ grievances.

Wells Fargo Mortgage Loans Are Best for:

- Individuals seeking a seamless online prequalification, preapproval, and application process.

- Borrowers desiring personalized assistance from a knowledgeable mortgage consultant.

- Homebuyers interested in exploring a variety of loan options to find the best fit for their needs.

Loan type offer :

Explore a wide array of mortgage options with Wells Fargo, including:

- Fixed-rate loans

- Adjustable-rate loans

- Jumbo loans

- Federal Housing Administration (FHA) loans

- Department of Veterans Affairs (VA) loans

- Mortgage refinancing”

Minimum Borrower Requirements :

Wells Fargo loans vary based on factors such as loan type and your credit profile. For instance, a conventional fixed-rate loan typically requires a minimum 3% down payment, while an FHA loan necessitates a 3.5% down payment, and VA loans are available with no down payment required.

Here are the credit score requirements for various loan types at Wells Fargo:

- Conventional: Minimum score of 620

- FHA: Minimum score of 640

- FHA Streamline: Minimum score of 600 if credit qualification is necessary; no minimum score if credit qualification is not required

- VA: Minimum score of 600

- Jumbo: Minimum score of 700

- Low-income loans: Expanded credit criteria apply

Pros & Cons:

Pros:

- publishes mortgage rates online.

- They offer online application tracking.

- Mortgage consultants are available in 39 states and Washington, D.C.

- They provide plenty of online resources.

Cons:

- Wells Fargo does not publish fees upfront.

- As of publishing, they do not offer home equity loans.

How Can you Qualify for Wells mortgage ?

Wells Fargo offers the option of considering nontraditional credit for individuals whose qualifying income falls at or below 80% of the area median income for the county where the home is situated.

This means that payment histories for utility and cable bills, which may not typically appear on credit reports, can be utilized to assist in the qualification process.

To qualify for a mortgage, borrowers with credit scores below 620 typically need to collaborate with a Wells Fargo mortgage consultant. The lender offers tools such as an affordability calculator to assist in understanding loan options.

Prospective borrowers can also undergo the online prequalification process to assess eligibility. Generally, a stronger financial profile, including factors like credit score, debt, and savings, expands the range of available home loan options.

Wells Fargo Mortgage Offers, Rates and Fees Overview:

What wells Fargo Offers:

Mortgage services across all 50 states and the District of Columbia. The interest rates for a 30-year fixed-rate conventional loan from Wells Fargo are similar to the current national averages. You can review the advertised interest rates on the company’s website for further information.

It offers various discounts to borrowers, including a Dream. Plan. Home. closing cost credit of up to $5,000 for those earning less than 80% of the area median income in eligible localities.

Additionally, borrowers may qualify for My Mortgage Gift awards when securing a loan within a specified timeframe. These awards can be redeemed for merchandise or a prepaid Visa card.

Wells Fargo Mortgage Rates:

| Product | Interest Rate | APR | Last Updated |

|---|---|---|---|

| 7/6-Month ARM Jumbo | 6.375% | 7.298% | 2/15/2024 10:15 AM EST |

| 15-Year Fixed-Rate Jumbo | 6.500% | 6.686% | 2/15/2024 10:15 AM EST |

| 30-Year Fixed-Rate Jumbo | 6.625% | 6.727% | 2/15/2024 10:15 AM EST |

Please note: Rates, terms, and fees are as of 2/15/2024 at 10:15 AM Eastern Standard Time and are subject to change without notice.

Wells Fargo Current Mortgage Rates >>> Rates

By clicking on the rates, customers can access detailed information about credit score requirements, down payment options, and other factors. Additionally, customers can obtain a customized rate by answering a few questions about their personal situation.

on its website, offering interest rates and annual percentage rates (APRs) for various types of loans, including conventional and government-backed purchase and refinance loans with fixed or adjustable rates.

Loan Options:

Wells Fargo offers both fixed-rate and adjustable-rate mortgages (ARMs). While fixed-rate loans maintain a consistent interest rate throughout the loan term, ARMs begin with a fixed-rate period, typically with lower initial rates, before potentially adjusting to higher rates in the future. Wells Fargo advises that ARMs may be suitable for individuals planning to sell or refinance before the fixed-rate period ends.

Fees Evaluation:

Wells Fargo receives a rating of 3.7 out of 5 stars for its average origination fee.

Mortgage interest rates 4 out of 5 stars for its average .

This assessment considers the balance between lender fees and mortgage rates, emphasizing that paying upfront fees can potentially lower the mortgage interest rate.

Wells Fargo advises that closing costs typically range between 2% and 5% of the purchase price. Upon applying, review your Loan Estimate, and shortly before closing, examine your Closing Disclosure for a detailed breakdown of fees, which may encompass origination charges, appraisal and credit report fees, survey and title search fees, taxes, government fees, prepayments for homeowners insurance, mortgage insurance, interest, and initial escrow payments.

Mortgage Rate Transparency:

- Rating: 4 out of 5 stars.

- Accessibility: Rates are easily found on the website under “Home Loans.”

- Information Availability: Sample rates are provided; customized rates require contact.

Refinancing:

In response to historically low interest rates in 2020 and 2021, many homeowners turned to refinancing with Wells Fargo. In 2021, a significant portion of our mortgage activity focused on refinancing, with 54.84% representing rate-and-term refinances and approximately 18% dedicated to cash-out refinances. This trend reflects our commitment to helping homeowners seize opportunities to optimize their financial situations through refinancing options tailored to their needs.

| Product | Interest Rate | APR |

|---|---|---|

| 7/6-Month ARM Jumbo | 6.625% | 7.428% |

| 15-Year Fixed-Rate Jumbo | 6.625% | 6.832% |

| 30-Year Fixed-Rate Jumbo | 6.750% | 6.877% |

Please note: Rates, terms, and fees are as of 2/15/2024 at 10:15 AM Eastern Standard Time and are subject to change without notice.

For Current Refinancing rate : Click here >>> Wells Fargo Refinancing Rate

How to apply for a mortgage with Wells Fargo?

- Online Application: Submit a complete mortgage application directly online. Unlike some other lenders, Wells Fargo allows you to input all necessary information online. After submitting your application, a representative will reach out to discuss the next steps. You can also use their online portal to track your loan’s progress and upload required documents. Click here >>> Online Apply

- Phone Application: If you prefer a more personalized approach, you can apply for a Wells Fargo mortgage over the phone. A representative will guide you through the application process.

- In-Person Application: Visit a Wells Fargo Home Mortgage Center to apply in person. You can search for nearby mortgage centers and find mortgage consultants who can assist you. This option can be helpful if you need assistance in a language other than English.

Regarding timelines:

- Preapproval: Wells Fargo doesn’t specify how quickly they can preapprove a mortgage application. However, the timeline from application to full approval generally ranges from 30 to 90 days.

- Closing Process: While you can e-sign some loan disclosures and closing documents, not all documents can be e-signed. Therefore, plan to meet with a notary in person for the closing process.

Talk to Wells Fargo Mortgage Consultant :

If you prefer to speak with a mortgage consultant directly to learn more about your options, feel free to give us a call at 1-866-290-0462. Alternatively, you can find a mortgage consultant in your area to discuss your needs and explore the best mortgage solutions for you.

customer service:

Wells Fargo offers accessible customer service via phone or online chat. The Mortgage Customer Service line operates Monday through Friday from 8 a.m. to 11 p.m. Eastern Time and Saturday from 9 a.m. to 3 p.m. ET, reachable at 800-357-6675.

As for online features, Wells Fargo enables borrowers to conveniently prequalify, apply for, and manage their mortgage loans through their website.