The U.S. government is allocating $1.5 billion to GlobalFoundries (GFS) to bolster semiconductor production, aiming to fortify domestic supply chains post-COVID vulnerabilities.

Highlights :

- Strengthening national security through domestic semiconductor production.

- Boosting economic growth and creating jobs.

- Reducing dependence on foreign suppliers.

- Fostering technological innovation and maintaining global competitiveness.

- Addressing industry challenges and vulnerabilities exposed by the pandemic.

Why U.S. Government Invests $1.5 Billion in GlobalFoundries for Semiconductor?

GlobalFoundries, the world’s third-largest contract chipmaker, plans to construct a new facility in Malta, New York, and expand operations in Burlington, Vermont, per a preliminary agreement with the Commerce Department. The grant is supplemented by $1.6 billion in loans, foreseeing a total investment of $12.5 billion across the two states.

Projects funded through the CHIPS and Science Act are projected to create over 10,000 jobs in the next decade, according to Biden administration officials. These roles will provide fair wages and benefits, including childcare support.

Commerce Secretary Gina Raimondo emphasized the significance of the chips manufactured by GlobalFoundries in the new facilities, highlighting their crucial role in national security.

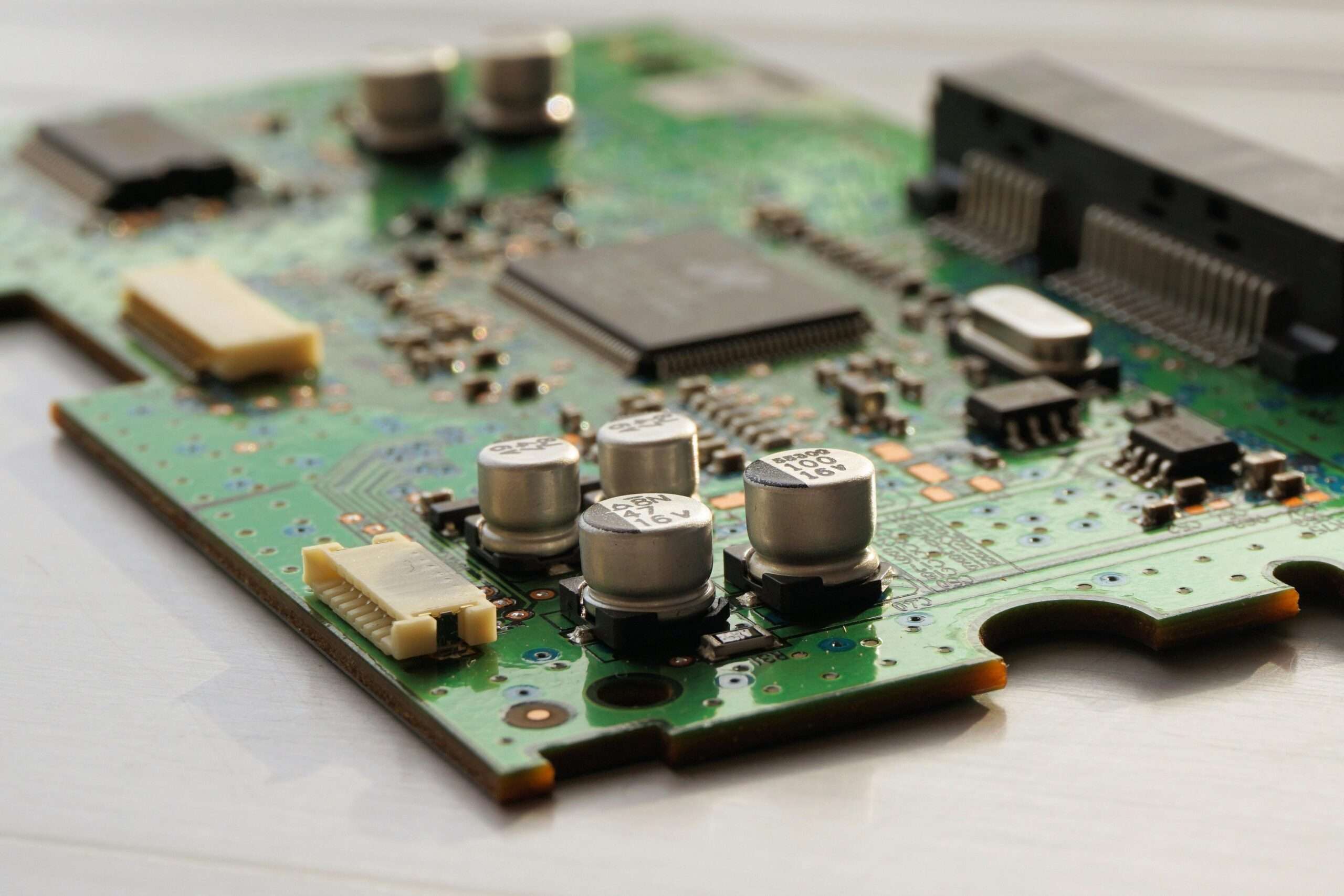

The chips, comparable in size to a fingernail, serve critical roles in satellite communication, space technology, and defense, as well as everyday applications like car safety features, Wi-Fi, and cellular connectivity,” officials stated.

Thomas Caulfield, President and CEO of GlobalFoundries, emphasized the need for the industry to focus on boosting demand for domestically produced chips and expanding the skilled semiconductor workforce in the United States.

In September, GlobalFoundries inaugurated a $4 billion semiconductor fabrication plant in Singapore, marking a significant step in its global manufacturing expansion.

Raimondo noted that this marks the government’s third CHIPS announcement, with her department intending to announce numerous funding awards in the upcoming weeks and months from the government’s $39 billion program aimed at enhancing semiconductor manufacturing.

We’re just scratching the surface,” Raimondo remarked.

The expansion of the Malta facility will guarantee a steady chip supply for auto manufacturers, including General Motors (GM), addressing the ongoing chip shortages in the automotive sector.

GlobalFoundries and GM recently inked a long-term deal to source U.S.-made processors, mitigating potential disruptions in production caused by chip shortages.

“This announcement ensures prevention of future disruptions,” Raimondo stated during a briefing.

The new Malta facility will manufacture high-value chips not currently produced in the United States.

Last details :

Lattici raise after Q4 Report

Lattice Semiconductor (LSCC) saw a modest uptick in its stock following its fourth-quarter report, which revealed mixed results and a cautious outlook. Despite this, LSCC shares rose by 1.8% to close at $72.30 on Tuesday.

Based in Hillsboro, Oregon, the company reported adjusted earnings of 45 cents per share on revenues of $170.6 million for the December quarter, falling short of analysts’ expectations of 45 cents per share in earnings on revenues of $176.2 million.

Looking ahead, Lattice anticipates revenue in the range of $130 million to $150 million for the current quarter. However, the midpoint of $140 million falls considerably below Wall Street’s projection of $174.4 million for Q1.

Chief Executive Jim Anderson remains optimistic about the company’s long-term prospects despite facing short-term challenges in the industry. He highlighted Lattice’s expanding product portfolio and strong customer traction as key factors driving future growth.

Semiconductor Market Dynamics:

GlobalFoundries and Lattice Semiconductor join a string of chipmakers revising analysts’ forecasts downward for the March quarter, with peers like Onsemi (ON) and Microchip Technology (MCHP) also adjusting guidance.

Companies with softer guidance typically operate in industrial, automotive, and communications infrastructure markets, while those benefiting are linked to the thriving artificial intelligence and recovering smartphone sectors.

In the fabless semiconductor industry group, Lattice holds the tenth position among 38 stocks, boasting an IBD Composite Rating of 86 out of 99. Conversely, GlobalFoundries ranks seventeenth out of 32 stocks in the semiconductor manufacturing group, with a lower IBD Composite Rating of 33.

Moreover, the upgraded Burlington facility will be the first in the U.S. capable of mass-producing next-generation gallium nitride on silicon semiconductors, crucial for electric vehicles, the power grid, and smartphones.